Today we are going to look at the resiliency and strength of multifamily thru the pandemic challenged 2020. As Covid-19 took root in Spring 2020, we were inundated with headlines about job loss, furloughs, and varying government regulations. Many investors and owners were concerned what may lay ahead and one could observe this in the drop in multifamily deal count. However, deal flow picked back up in the second half of the year as property owners began to observe stronger than expected tenant trends.

As we begin 2021, US apartment occupancy is still very strong, averaging 95.6% and only down 10 basis points y/y.

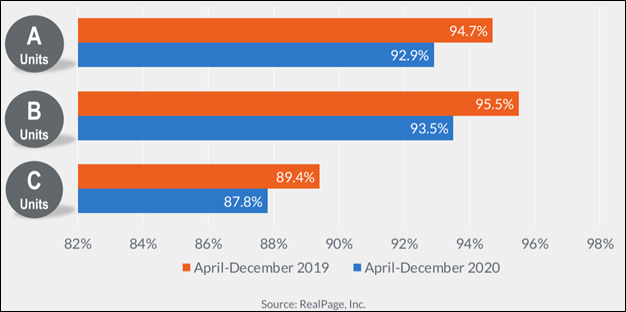

Our historical focus has been in Class B and Class C properties, both of which offer the highest sub-class occupancy rates. In our opinion, successful future investments will continue to target higher quality properties in these asset classes.

One may naturally ask, well the apartments may be occupied but isn’t there an eviction moratorium and thousands of tenants not paying? Your collected rents and income must be way down? Well, more good news on this front. Although there has been a decrease in rent payments y/y, drops have been very minimal at a 1-2% average.

Occupancy is still at historic highs and the majority of tenants are paying rents thanks to strong demand fundamentals, ongoing demographic trends, and government stimulus. The resiliency of apartment communities through one of the toughest years most of us have experienced is extremely promising. A strong response to macroeconomic pressures highlights the strength of multifamily investments. We believe this portends well for the future, and that any investor should own multifamily real estate as a cornerstone asset in their portfolio.

Want the latest best real estate hacks delivered straight to your inbox? Click here to subscribe to our exclusive newsletter!